Introduction

Loan Shark AI is an innovative SaaS platform providing AI-powered loan analysis to protect borrowers from predatory lending. It empowers individuals to make informed financial decisions by exposing hidden fees and complex terms in loan documents, ideal for anyone seeking to understand or refinance a loan.

Key Features

- Fine Print Probe: Uncovers hidden fees, escalation clauses, and risky terms in legal documents.

- Credit Score Impact: Shows how credit scores affect rates and reveals savings opportunities.

- Refinance Advisor: Offers smart refinancing analysis with lender recommendations and savings projections.

- Document Analysis: Securely upload PDF, DOCX, or scanned images for instant AI-powered insights.

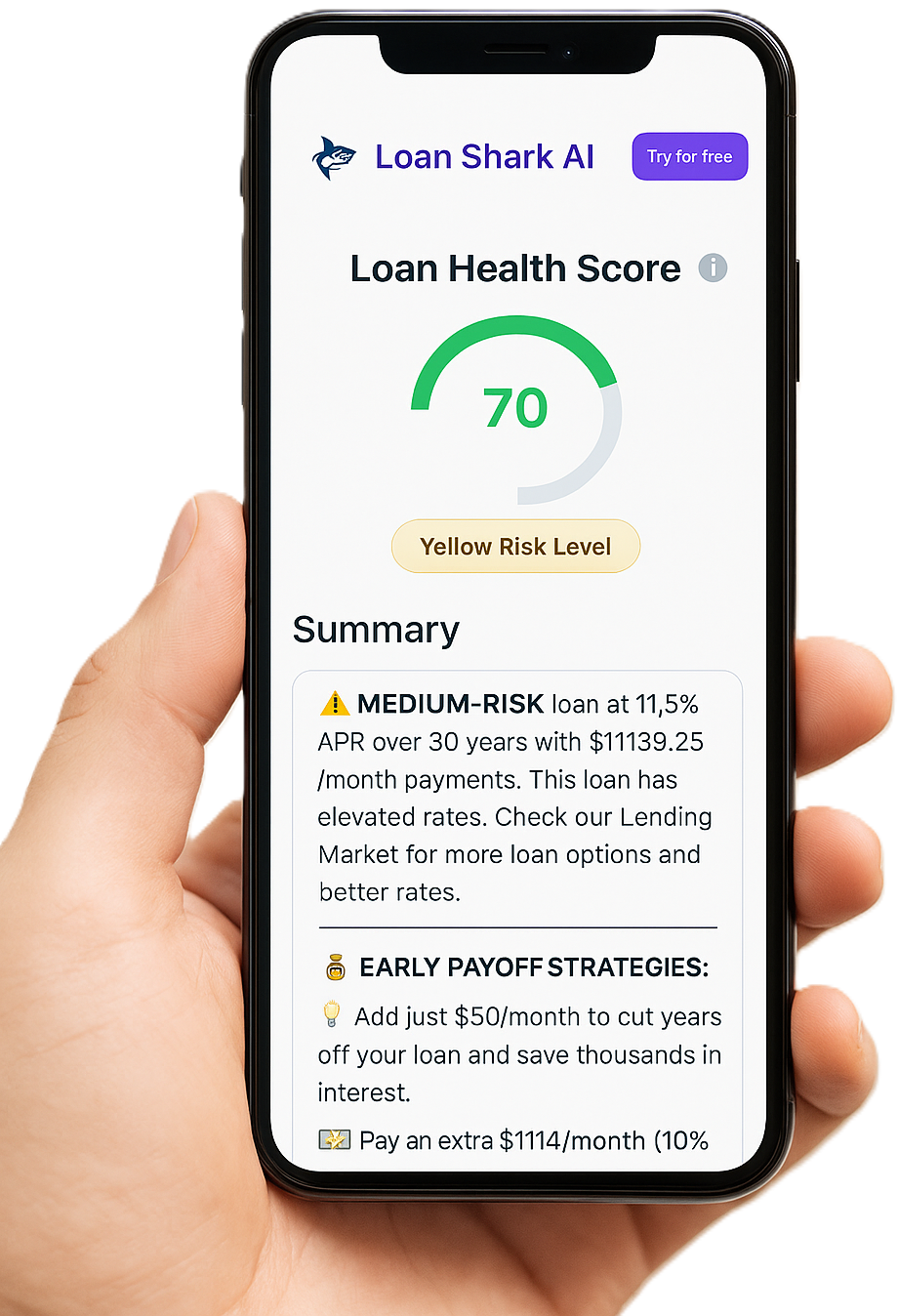

- Health Score & Risk Assessment: Provides a comprehensive evaluation of your loan's overall health.

- Payment Stress Test: Helps users understand their ability to manage payments.

Use Cases

This platform is invaluable for individuals applying for new loans (mortgages, auto, personal) by acting as a crucial second pair of eyes. It helps identify and negotiate away hidden fees or predatory clauses, potentially saving thousands. For those considering refinancing, the Refinance Advisor provides personalized recommendations and detailed projections, enabling confident choices to save money and understand long-term credit impact.

Pricing Information

Loan Shark AI offers a flexible pricing model, including a Free plan for basic analysis. The One-Time Use plan is $9.99 per analysis for advanced features. The Pro plan, at $19.99 per month, provides unlimited uploads, loan scenario simulations, and priority support. An Enterprise option is also available with custom pricing.

User Experience and Support

The platform ensures ease of use with straightforward document upload and instant AI analysis, translating complex legal jargon into clear, actionable insights. Priority processing and support are available for Pro and Enterprise users. A Help Center, Glossary, and Contact Us options provide comprehensive support.

Technical Details

Loan Shark AI employs professional-grade technology with a strong focus on privacy and data security. It uses end-to-end encryption for all data. Documents are processed securely in memory only and are deleted immediately, ensuring no permanent storage of sensitive financial contracts. This commitment adheres to enterprise security standards.

Pros and Cons

- Pros: Protects borrowers from predatory lending; AI-powered analysis provides clear, actionable insights; Strong emphasis on privacy and data security (no permanent storage, encryption); Offers a free tier and flexible paid plans; Comprehensive features for loan analysis, credit impact, and refinancing.

- Cons: Analysis is not legal or financial advice; Advanced features are locked behind paid tiers; No explicit mention of specific programming languages or frameworks.

Conclusion

Loan Shark AI is a vital tool for navigating complex loan agreements. By demystifying fine print and offering intelligent insights, it empowers borrowers to make confident, informed financial decisions and avoid costly pitfalls. Explore Loan Shark AI today to safeguard your financial future.

Comments

Achievement

Publisher

Paul Murphy

Launch Date2025-09-21

Platformdesktop

Pricingfreemium

Tech Stack

#web