Introduction to RRG Chart

RRG Chart offers a powerful, free Relative Rotation Graph (RRG) analysis tool designed to help investors, analysts, and traders track sector, industry, and commodity momentum. Its primary purpose is to identify crucial market leadership shifts and rotation patterns with professional-grade analysis, making sophisticated insights accessible to all.

Key Features

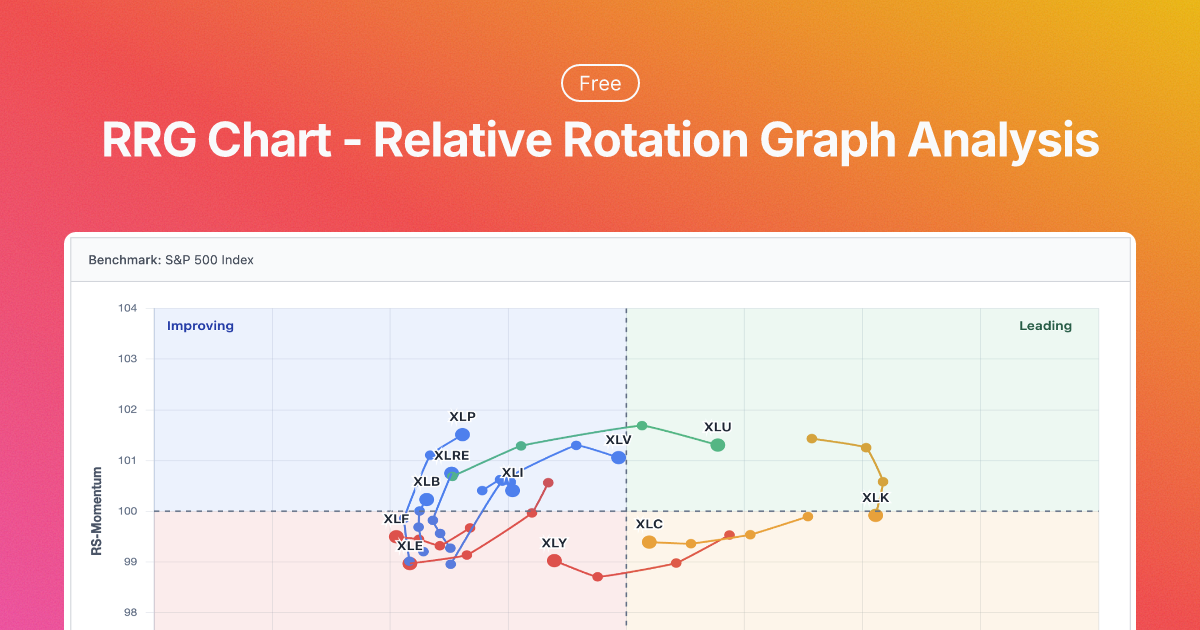

- Quadrant Analysis: Visually identify leading, weakening, lagging, and improving sectors relative to market benchmarks like the S&P 500.

- Momentum Tracking: Monitor sector rotation patterns over time with configurable time windows.

- Multi-Level Analysis: Gain comprehensive market leadership insights with sector, industry, and commodity-level rotation analysis.

- Weekly Data Updates: Data is updated weekly, typically on Fridays, providing a clear view of trends.

- Historical Data Access: Access up to 1 year of historical RRG data for in-depth trend analysis and backtesting.

- Completely Free: Professional-grade market analysis tools are provided without any cost barriers.

Use Cases

RRG Chart is invaluable for making informed investment decisions. Users can identify potential buying opportunities by focusing on sectors moving from "Improving" to "Leading," leveraging positive relative strength and momentum. Conversely, monitoring sectors in "Weakening" helps identify potential exits. The tool also supports strategic asset allocation by tracking momentum changes and utilizing historical data to identify long-term sector rotation patterns, seasonal trends, and market cycle behaviors across broad sectors, specific industries, and key commodity markets.

Pricing Information

RRG Chart is completely free to use. There are no hidden costs, subscriptions, or payment requirements to access any of its features, including sector analysis, industry analysis, commodity analysis, and historical data.

User Experience and Support

The platform is designed for professional-grade analysis with a focus on accessibility. Its visual Quadrant Analysis makes complex market rotation patterns easy to understand. While specific documentation or dedicated support channels aren't detailed, the comprehensive FAQ section within the tool provides essential information about Relative Rotation Graphs and their application.

Technical Details

The provided information does not specify the underlying programming languages, frameworks, or technologies used to build the RRG Chart platform. It is presented as a web-based tool delivering professional market analysis.

Pros and Cons

- Pros: Free, professional-grade analysis, multi-level insights, historical data, weekly updates, clear visualization.

- Cons: Weekly data (not real-time), no explicit customer support, initial learning curve for RRG concepts.

Conclusion

RRG Chart provides an unparalleled opportunity to access institutional-quality market rotation analysis and sector momentum tracking without any cost. It empowers investors to make more informed allocation decisions by clearly visualizing market leadership. Explore RRG Chart today to gain a competitive edge in understanding market dynamics.

Comments

Achievement

Publisher

Brian Chan

Launch Date2026-01-05

Platformweb

Pricingfree

Tech Stack

#web#cloudflare#nodejs#api